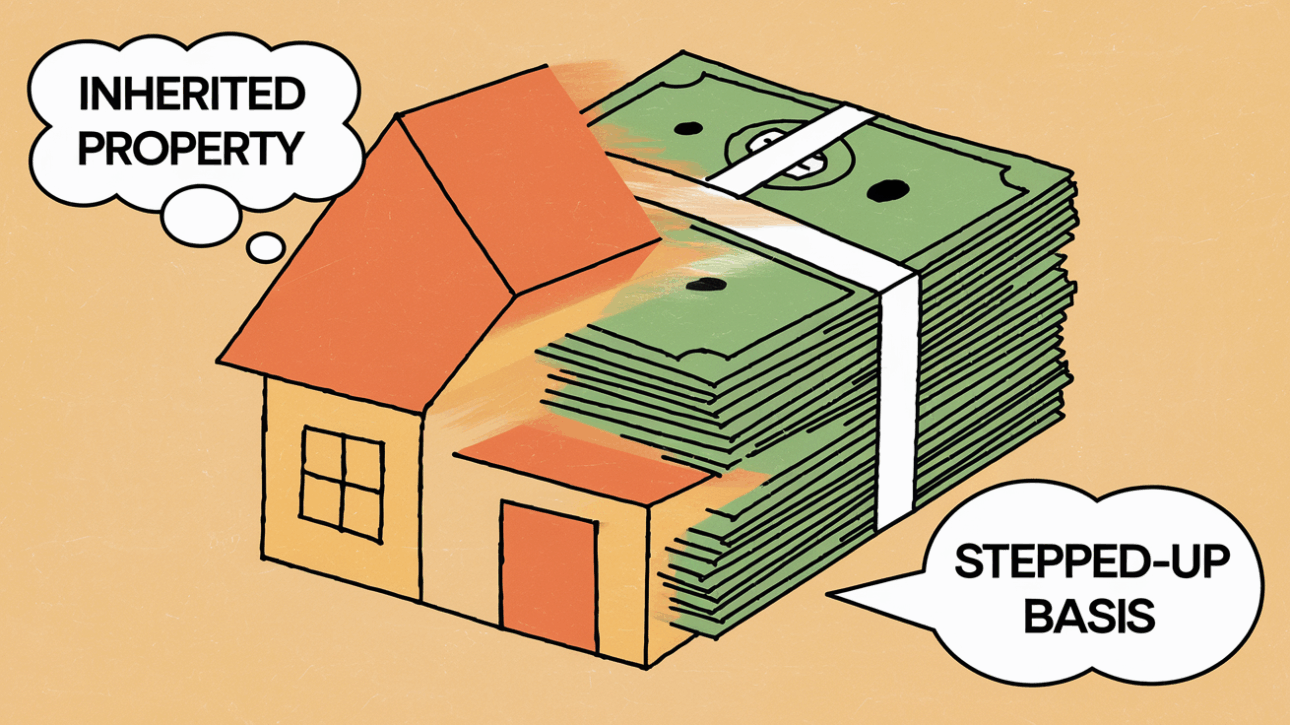

Inheriting assets like a house or stocks can be a mix of emotions. While it's a time to remember loved ones, it also comes with tax questions. One important thing to know about is the "step-up basis." It might sound complicated, but don't worry, we'll explain it in a way that's easy to understand.

Key…