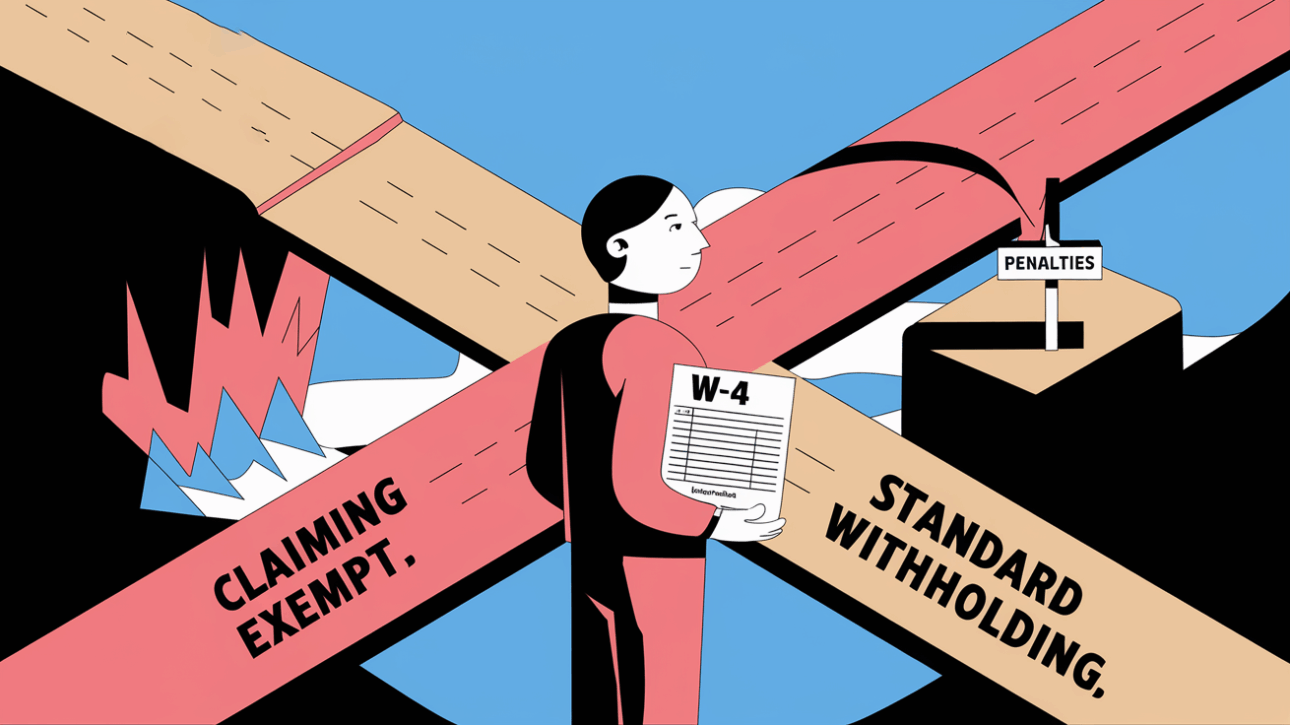

At XOA TAX, we often get questions about W-4s, especially the "exempt" status. It sounds pretty great, right? No taxes withheld from your paycheck! However, claiming exempt when you shouldn't can lead to some unpleasant surprises come tax time. Let's break down what it really means to be exempt and how to avoid making a…