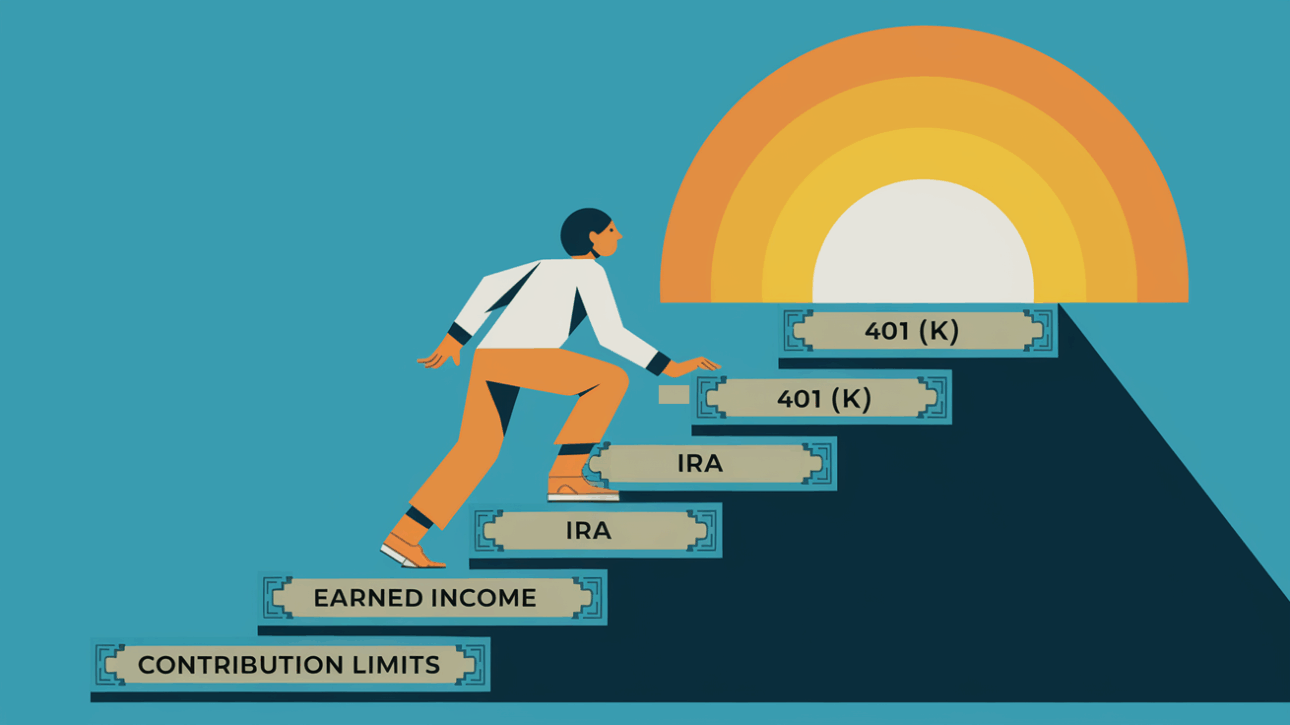

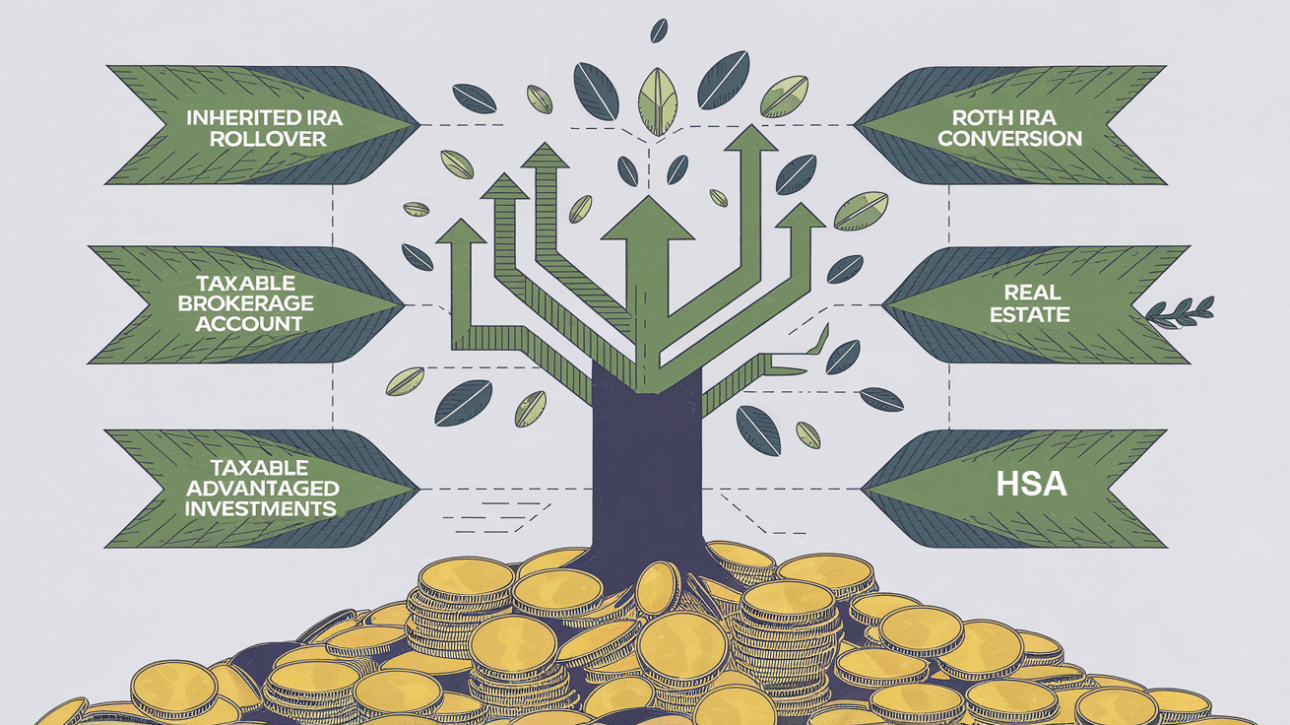

Planning for a comfortable retirement is a priority for many, but it can seem challenging when you're working with a limited income. The good news is that with careful planning and an understanding of contribution limits, you can still build a solid nest egg. At XOA TAX, we often help clients navigate these complexities. Let's…