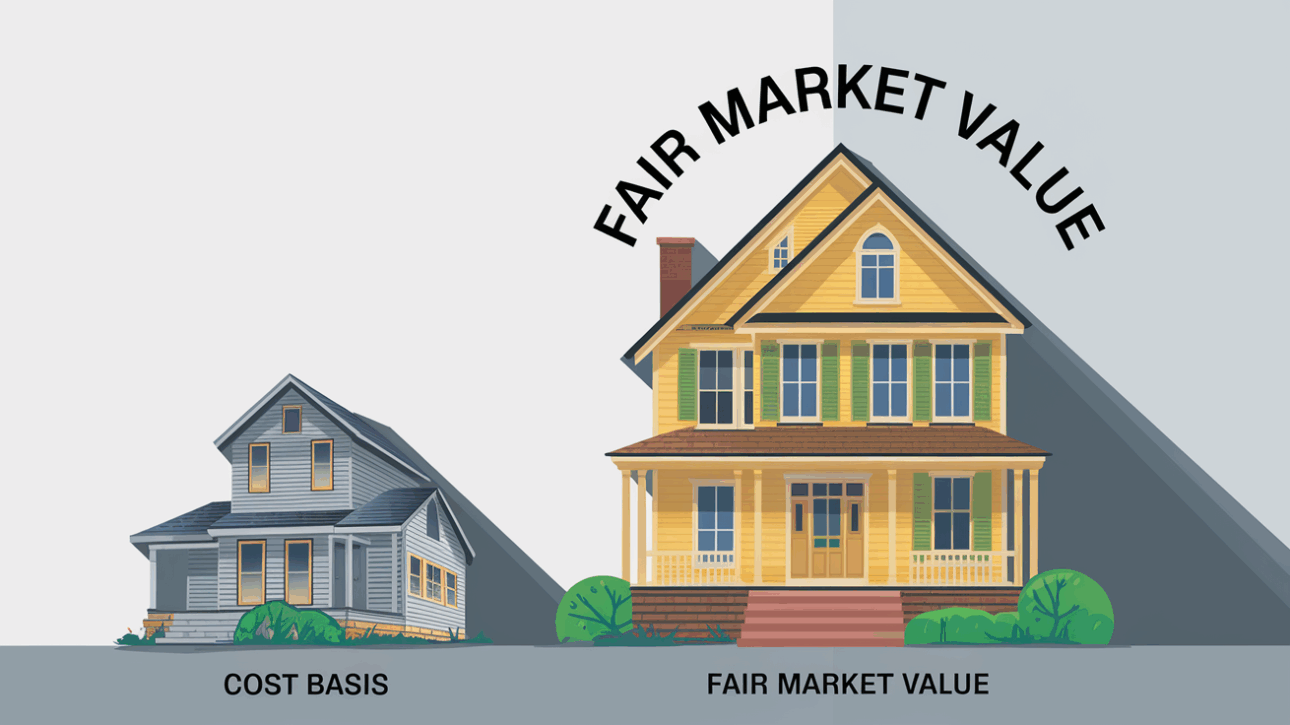

Losing a parent is an emotionally challenging experience, and navigating the complexities of their estate can add to the burden. One common area of confusion involves understanding the "stepped-up basis" when inheriting property. This concept can have significant implications for your tax liability, especially when it comes to real estate. Let's break it down.

Key…