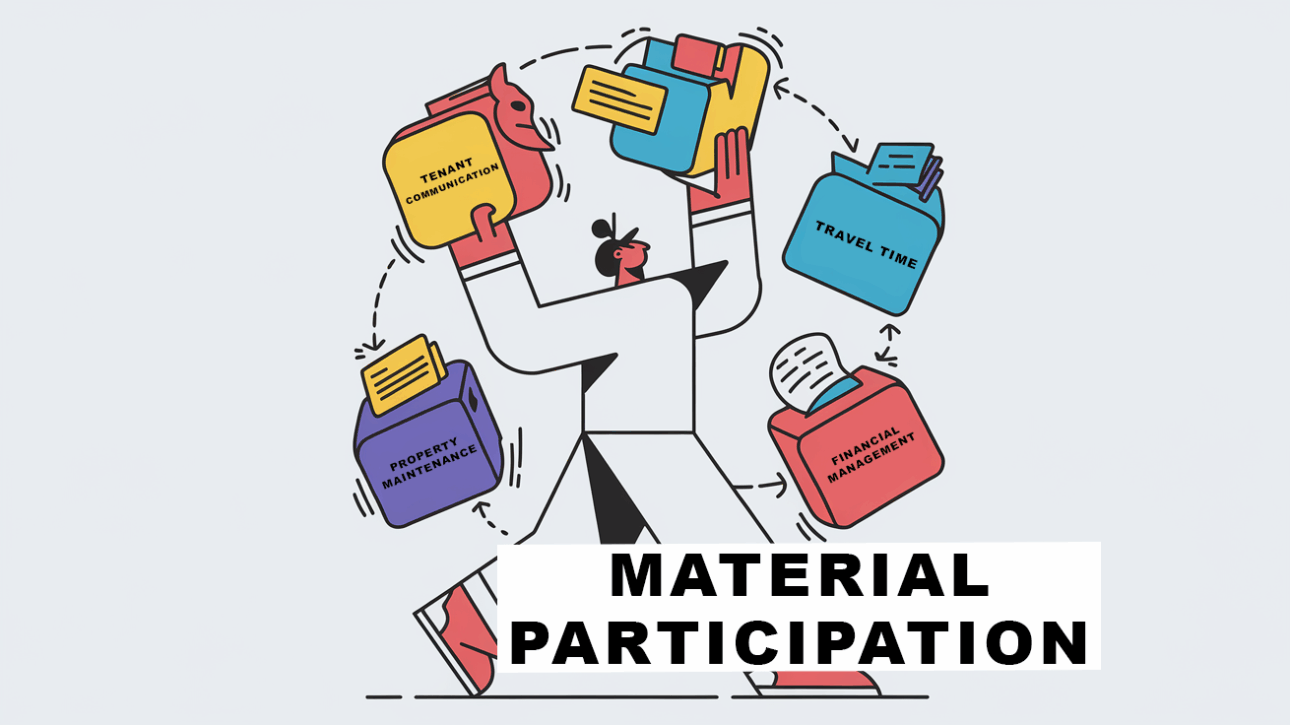

At XOA TAX, we often work with real estate professionals seeking to maximize their tax benefits. One common area of confusion is material participation, a critical factor in determining whether rental income is considered passive or non-passive (See IRS Code Section 469). This distinction can significantly impact your tax liability.

What is Material Participation?

The…